By Ebrima Conteh

The Coronavirus disease’s negative impact on the world economy is self-evident, in that it has a cascading effect that will affect every country in the world and every sector of the world’s economy. Once unthinkable in 2020, it is now abundantly clear that the world is in a long global recession. In an attempt to slow the process of the world economy from going into a depression central banks and governments are now scrambling to prescribe gauntlets of economic fixes like quantitative easing, interest rate cuts, loan guarantees and stimulus packages.

The United State Senate is working to finalizing a trillion dollar stimulus bill as the Coronavirus economic calamity grows; in a sharp contrast with the bickering that characterized Europe’s response to the financial crises a decade ago. This time, Europe has shown a sense of urgency and unity of purpose by announcing billions of euros in economic aid to curb the crisis.

We live in a global village with multi-national companies in all parts of the globe; dependent economies and expatriates who live and work in foreign countries thus no single country will be immune to the looming depression. However, advance economies are far more likely to absorb the shock and managed debilitating effects of an economic depression in contrast to weaker economies in regions like sub-Saharan countries, which will unfortunately not fare well.

Moreover, the immediate direct negative effect of the Coronavirus financial crisis on regions in Sub Saharan Africa will be a reduction of aggregate remittances. The importance of remittances in the Sub-Sahran economy bceuase it accounts for a substantial amount of the Gross Domestic Product. Case in point remittances account of approximately 25 percent of The Gambian’s Gross Domestic Product (GDP). It is these remittances that help families cater for their daily bread hence any reduction in remittances will make families back home who are entirely dependent on them short of meeting their basic necessities.

Economic crises are a constant in life, therefore using remittances to build a wall that will ensure that crises in the West do not have a debilitating effect on weaker economies should be a topic of interest.

While the effect of remittances on poverty is evident, there is no agreement on the effect on the broader concept of development and wealth creation. There is however, no doubt that remittances reduce poverty, but the effect on wealth creation depends largely on how remittances are used by the receivers. For example, if the remittances are untouched under the mattress, then they produce no effect whatsoever but if used for expenses in relation to health, education, investment, or the refurbishment of a home, then the net effect is/will be positive.

Based on the analysis above, the effect of remittances on development in sub-

Saharan Africa is very limited because remittances alone cannot pull Sub-saharan Africa from poverty. A radical new wave of thinking is therefore required today more than ever before to pull Sub-saharan Africa out of poverty. What sub-Saharan Africa needs during this global financial crisis is a credit based system to create wealth; developed countries with mature economies depend on credit to create such wealth. If credit is available, wealth can be easily generated through entrepreneurial ventures, these ventures will eventually lead to job creation and better living for everyone.

Credit is a Wealth Multiplier:

In Adam Smith’s book, An Inquiry into the nature and Causes of the Wealth of Nations, he imagined a system for creating wealth and a better livelihood for everyone. Poor nations especially in Sub-saharan Africa should take these ideas further by encouraging the Diaspora to begin saving some portion of the remittances they send in local banks. If the Sub-saharan Diaspora saves in local banks, those savings have the potential of creating more wealth and jobs hence a better living for all.

Entrepreneurs in developed nations with mature economies use credit to expand business; poor nations should do as well.

As long as market women, farmers, laborers, and business people see an economic reward for their efforts, the whole economy will prosper. According to Adam Smith, as people try to improve their own situation in life, their efforts serve as an invisible hand that helps the economy to grow and prosper through production of needed goods, services and ideas.

If given loans and empowered; farmers, market women, builders, laborers and entrepreneurs working in their own self-interest will produce goods, services, and wealth to become wealthier. Since these entrepreneurs will have to expand their businesses to produce more goods and as businesses expand, the more people will have job opportunities.

Because of the Diaspora saving in local banks, entrepreneurs will have access to capital to create more wealth and grow the economy. The premise of my theory is that if managed effectively, the impact of remittances from Sub-saharan Migrants has a greater dimension and can be used as a powerful force to reduce poverty because the invisible hand will turn self-directed gain into social and economic benefit for all.

References:

Shivani Puri and Tineke Ritzeme, Migrant Worker Remittances, Micro-finance and the Informal Economy: Prospects and Issues, Working Paper nr 21, Social Finance Unit, International Labour Organisation, Geneva, 1999.

Richmond Tiemoko, Migration, Return and Socio-Economic Change in West Africa: The Role of Family, Working Paper nr 15, Sussex Centre for Migration Research, University of Sussex, 2003.

Sulemana Braimah. Reducing Poverty and Diseases in the World No Improvements in Sub-Saharan Africa, (22, March., 2009)

http://povertyworlddevelopment.suite101.com/article.cfm/poverty_in_subsaharan_africa#ixzz0FsfwYOvM (visited18, May 2009)

Ends

Hi there to all, how is everything, I think every one is getting more from this website, and your views…

That is so true. Omg, you nailed it. That is exactly typical Gambian attitude unfortunately, it is very depressing.

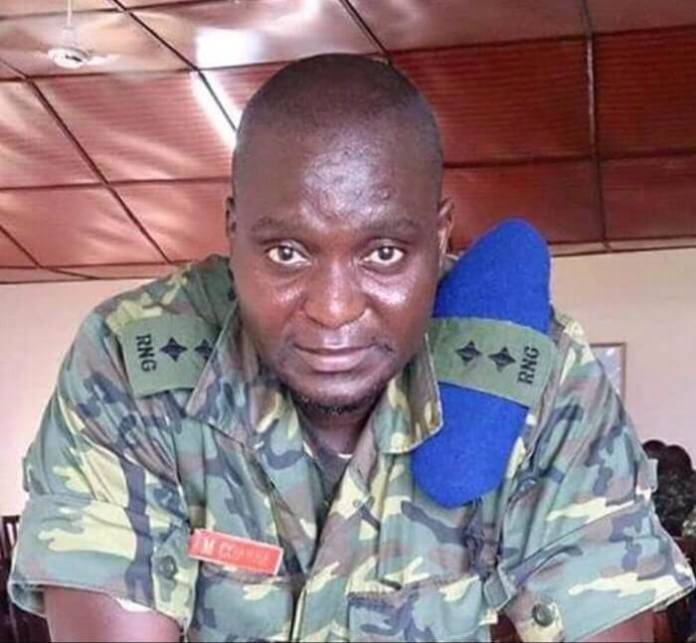

Ba Buwa is a great man! I first heard his name when I was in Kiang Karantaba Primary School between…

[…] cuatro cuestiones que el comité no pudo resolver son las siguientes: canepa kanye Bubba (Bobby) Sangiang y Momodo Lamine…

Honestly, everything you said here was true and valid. He is obviously my inspiration and motivation. He is my Dad.